![]()

The Mortgage System: A Cycle of Corruption That Needs to Change

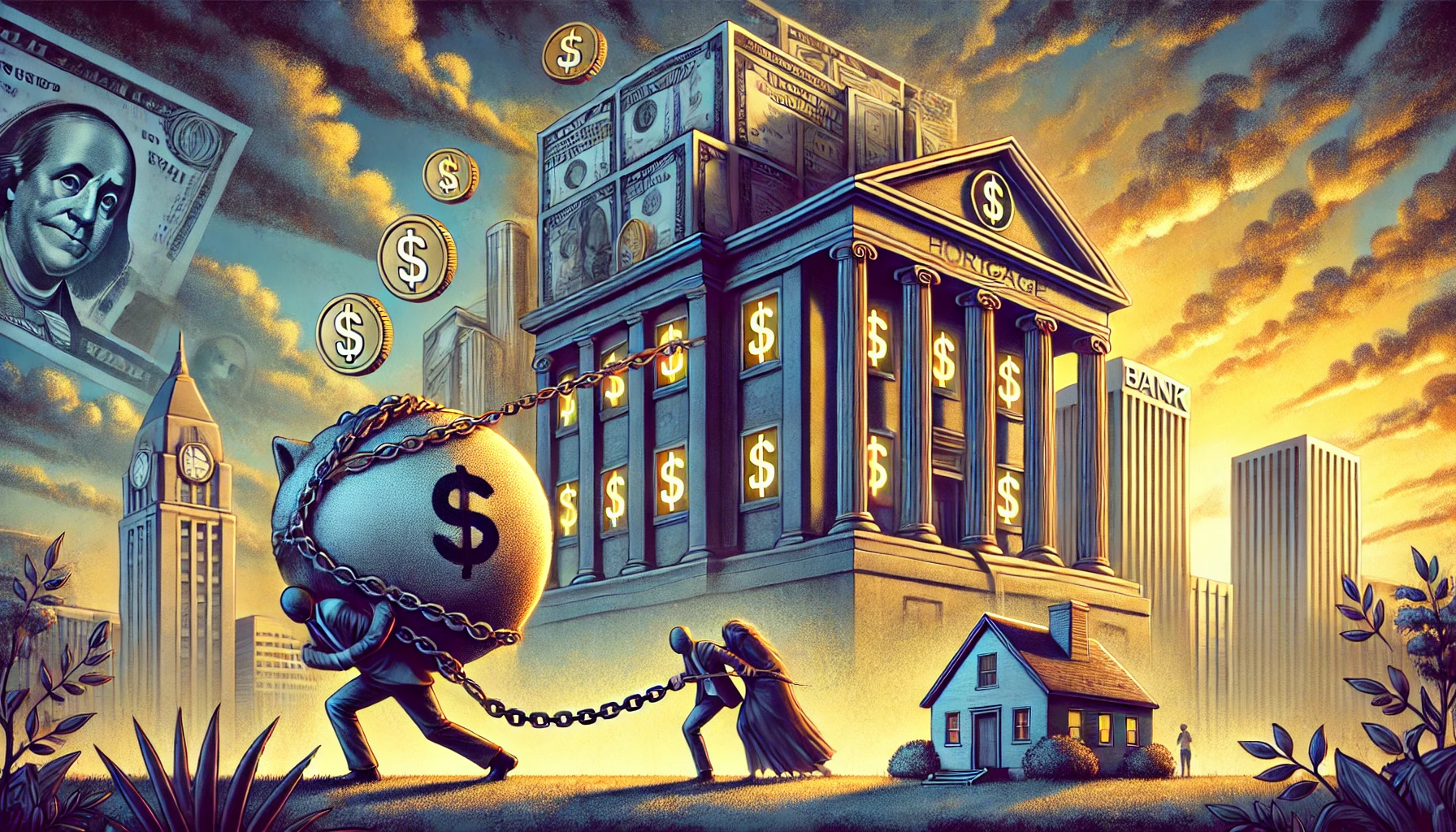

When you think about the journey of buying a home, it should represent stability, security, and ownership. But for far too many people, it becomes a financial burden that traps families in debt for decades. The mortgage system, which was originally designed to help people achieve the dream of homeownership, has evolved into a mechanism of profit for financial institutions. The truth is, the system is fundamentally flawed, and corruption has taken such a deep hold that it now disproportionately benefits banks at the expense of homeowners. It’s time to call out this broken system for what it is and demand meaningful change.

Paying Several Times Over for the Same Home

One of the most glaring flaws in the current mortgage system is the way it forces homeowners to pay several times over for the same property. When you take out a mortgage, you’re agreeing not just to pay the price of the home but also to pay substantial interest over the term of the loan. By the time most homeowners pay off a 25- or 30-year mortgage, they’ve paid two or three times the original value of the house—sometimes even more.

This isn’t just about interest rates being high. It’s about how the system is structured to prioritize profit over fairness. Compound interest, long loan terms, and penalties for paying off loans early are just some of the ways that lenders ensure they squeeze the maximum amount of money out of homeowners. What should be a pathway to stability and wealth-building often becomes a treadmill of payments that leave families financially drained.

A System Designed to Enrich Banks, Not Homeowners

The mortgage system wasn’t always this way. Originally, it was created as a tool to help people afford homes, spreading the cost over time to make it manageable. But as banks realized how lucrative mortgages could be, the system shifted to prioritize profits. Now, banks don’t just make money from the interest on your loan; they also bundle and sell those mortgages to investors in the form of mortgage-backed securities. This creates a cycle where financial institutions profit at every stage, from origination to sale, leaving homeowners to bear the brunt of the costs.

This system also allows banks to take on less risk while still reaping massive rewards. If a homeowner defaults on their mortgage, the bank can often recover its money through foreclosure, government-backed insurance, or by selling the property. Meanwhile, the homeowner is left without a home, often with significant financial losses and damaged credit. This one-sided arrangement disproportionately benefits financial institutions, making it clear that the system is designed to serve them, not the people it’s supposed to help.

The Human Cost of an Exploitative System

The impact of this corrupt system extends beyond financial strain. Families are forced to make sacrifices to keep up with their mortgage payments, often cutting back on essentials like healthcare, education, and retirement savings. Many first-time buyers enter the housing market with optimism, only to find themselves burdened by a lifetime of debt. This creates a ripple effect, where financial insecurity becomes a constant source of stress and anxiety.

Additionally, the housing crisis disproportionately affects low-income families and marginalized communities. Predatory lending practices, discriminatory policies, and unequal access to credit have historically excluded certain groups from the benefits of homeownership. These systemic issues only deepen the divide between the wealthy and the rest of society, perpetuating cycles of poverty and inequality.

There Is Enough Money for a Fairer System

One of the most frustrating aspects of the current mortgage system is the fact that there is more than enough money in the world to make it fairer. If interest rates were significantly lower and designed to cover only the administrative costs of processing loans, millions of families could afford homes without being financially suffocated. The reality is that high interest rates and excessive fees are not necessary for the system to function; they exist to generate massive profits for banks and their shareholders.

We live in a world where technological advancements and global wealth should allow for more equitable systems. Automation, for example, has significantly reduced the costs of processing loans, yet these savings are rarely passed on to borrowers. Instead, the system remains rigged in favor of financial institutions, which continue to extract as much profit as possible from every transaction. This isn’t just unfair; it’s immoral.

What Needs to Change

The mortgage system is long overdue for a complete overhaul. Here are some key changes that could make a real difference:

- Lower Interest Rates: Mortgage interest rates should be capped at a reasonable level to ensure that banks can cover their costs without exploiting homeowners. Governments could also offer low-interest public lending programs as an alternative to traditional banks.

- Transparency: Homebuyers deserve to know exactly where their money is going and how much they’ll ultimately pay over the life of their loan. Clear, upfront disclosures should be mandatory, and hidden fees should be eliminated.

- Accountability for Financial Institutions: Regulators must hold banks accountable for practices that disproportionately benefit their executives at the expense of borrowers. This includes cracking down on predatory lending, unfair fees, and discriminatory policies.

- Alternative Models: Governments and communities should explore alternative approaches to home financing, such as shared-equity models, cooperative housing, or rent-to-own programs. These options can provide pathways to homeownership that don’t rely on exploitative mortgage systems.

- Stronger Consumer Protections: Homeowners should have more rights and protections, including safeguards against foreclosure and options for refinancing under fair terms.

A Call to Action

The time has come to demand change. The current mortgage system is unsustainable, unethical, and deeply unfair. Owning a home should not mean being trapped in a financial cycle that benefits banks at your expense. It should be a source of pride, security, and stability.

We need policymakers, advocates, and everyday people to come together and push for meaningful reform. This means holding financial institutions accountable, supporting alternative models, and demanding a system that prioritizes fairness and accessibility over profit. Together, we can build a future where homeownership is a right, not a privilege, and where families can thrive without the weight of unnecessary debt.

Let’s break the cycle of corruption and create a mortgage system that works for everyone. The dream of homeownership is worth fighting for, and it’s time to reclaim it from the hands of those who would use it for their own gain.

Please support this journey by sharing.

It’s more important than ever, to work closer together to help make the World a Better Place

Let’s get ahead of the scammers and keep people safe!

grahamhodsdon.com is Proudly powered by WealthyAffiliate

If you want to learn how to produce your own site easily and effectively Wealthy Affiliate has the best community in the world for this. Very easy steps to follow and broken down in a way that everyone can follow at their own pace. Unlock Your potential to share what you would like to share with ease.